INTRODUCTION:-

Income tax, as many know, is a direct tax and is taxed according to various income sources received by an individual or an entity ina financial year.

In India, income tax is based on a simple principle –

“Tax the rich and leave the poor.”

The tax rates are based on income slabs, and they increase with increasing income slab.

Corporate entities like private limited, partnership firms, LLPs are taxed at the highest rate of 30%, in which individuals are taxed at lower rates as per their income slabs.

INCOME TAX IN INDIA:-

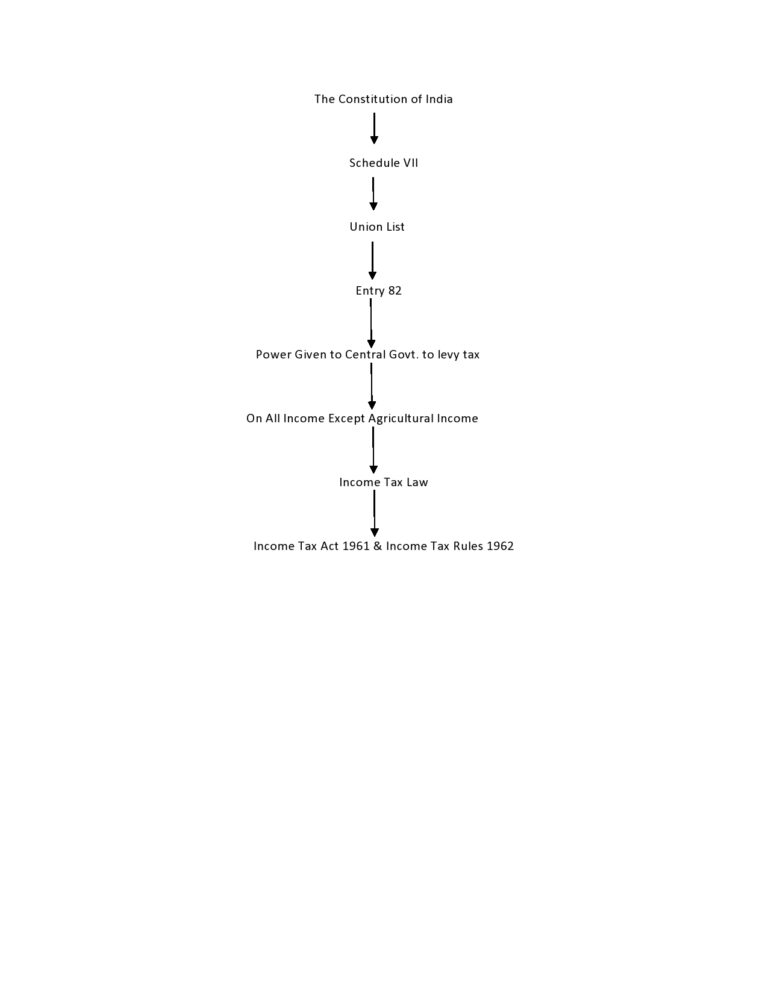

Legality

Flowchart

Who administers

CBDT means The Central Board of Direct tax monitors the income tax department and itself(CBDT) comes under the revenue department of the finance ministry. Income tax is a significant source of income for the government itself.

FIVE MAIN HEADS OF INCOME:

1.Income from Salary:-

The first head of income is a salary income. It includes all the remuneration of an individual from a salary or a job.

It also considers the various allowances and perquisites received by an individual during its usual course of a job. Allowances are the amount received by an individual for expenses done at the office or for the office.

These are also taxed unless they are specifically exempt. Also, as said above, most of the perquisites are taxed and are dealt with by section 17 of the income tax act. These are benefits received in addition to a salary which is right of an employee due to his employment. Example: Rent Free Accommodation, Group Insurance.

2.Income from House Property:-

Section 22 to 27 of the Income Tax Act deals with income from house property and includes all income received by an individual from land or house. The income of house property has a standard deduction of 30% from the rental income for all the incidental expenses done by a person to maintain the property. A distinct point to be noted is that a vacant property is taxed as per the standard rent it can receive according to the area or location

3.Income from Profits of Business:-

The third and essential head of income is profit from business or profession. This income is nothing but a business income. Business income’s taxation and computation is a lengthy process, as to arrive at a taxable profit whole of the accounting and analysis need to be done. All income received like professional fees, commission, revenue from operations, etc. are considered here as income, and all the incidental expenses made to make that transaction happen are considered as expenses. Subtracting both of them will arrive at a profit which is taxed according to the applicable tax rates.

4.Income from Capital Gains:-

Capital Gains are the profits or gains earned by an assessed by selling or transferring a capital asset, which was held as an investment or for any other purpose. Capital assets are assets that are held for a longer period and usually not bought or sold in the usual course of operational revenue. This is the most complicated or tricky part of the Income Tax Act as capital gains calculation is bit tricky and tax on the same, if it is proved as a ltcg, is at flat rate irrespective of the income slabs.

5.Income from other sources:-

Section 56(2) deals with this fifth source of income. Income from other sources is all income, which cannot be considered in the above four mentioned income tax heads. It is an inclusive head rather than exclusive.

TAX RETURNS:-

There are four categories of income tax returns as below:

1. Standard return u/s 139(1)

This return is the section under which all the in-time returns are filed. Every entity or individual having income more than the basic income slab must file a return under this section for the financial year before the given due dates. Generally, 31st July in case of individuals and non-audit entities.

2.Belated return u/s 139(4)

As the name suggests, it is a return that is to be filed if you are filing late or you missed the due date. From FY 2018 -19, one can file a belated return for a financial year only till march month of its assessment year. E.g., A income tax return of April 2018 to March 2019 can maximum be filed till 31st March 2020.

3.Revised return u/s 139(5)

If any omission or mistake was made while filing the original return, then one can file an amended return under this section. From FY 15-16, One can file an amended return only if you have first filed a return in time and not filed a belated return.

4.Defective return u/s 139(9)

Assessing officer can intimate the defects in a return filed. Nowadays, this intimation is computer-generated, and an individual receives a defective return intimation on his mail. One should generally rectify the mistake in 15 days on receipt of intimation, if not it can be considered as an invalid return.

Apart from the categories mentioned above, the return is also required to file in response to notices under the various sections.

Also Read : How to get quick Income Tax Refund , Income Tax Deductions for Salaried Class under old scheme

Due Date of Income Tax Return

As per the income tax act generally, the due date for income tax returns is as follows :

Non Audit Entities: 31st July of AY

Audit Entities: 30th September Of AY

Income Tax Due Date for FY 2019-20 Extended due to Coronavirus

However, for FY 2019-20 income tax return due date or income tax return extended due date is

Non Audit Entities: 30th November 2020

Audit Entities: 31st October 2020

Filling the return in due date is very important as it gives the taxpayer a one more chance to revise it if it has some mistakes or omissions.

You can read latest news about tax due date extension on : Live Mint

CONCLUSION:-

Given a brief about income tax and its various forms, it is necessary for every individual who is earning Income in India to file Income Tax Return by accurately computing the same. Also, in India, as the tax structure is complicated, it is highly advised to take the help of professionals to file the returns.

We at Consultaxx not only help you file your various tax returns but also guide you in your wealth planning and growth. What makes us different is our connectivity, availability, and accuracy. We are a team of professionals who give personalized and expert service in filling returns. We have a free chat service 24*7 on our site for consultation and free advice.Also, a dedicated online account is given to each assessee to store his documents and track his work given to us.